Contents

- 1 Discount Received Journal Entry: Meaning & Example

- 1.1 What is a Discount Received?

- 1.2 Importance of Discount Received in Accounting

- 1.3 Discount Received Journal Entry – Meaning

- 1.4 How to Record a Discount Received Journal Entry

- 1.5 Benefits of Recording Discount Received

- 1.6 Practical Tips for Businesses

- 1.7 Common Mistakes to Avoid

- 1.8 Discount Received vs Trade Discount

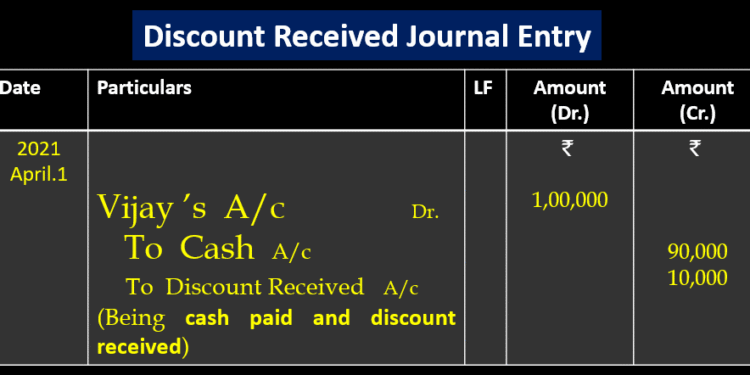

- 1.9 Examples of Discount Received Journal Entry

- 1.10 Conclusion

Discount Received Journal Entry: Meaning & Example

In the world of accounting, understanding how to record transactions accurately is vital. One such common transaction is a discount received from a supplier. If you have ever wondered how to record it, this guide on Discount Received Journal Entry will help you understand its meaning, purpose, and practical application in a simple and effective way.

What is a Discount Received?

A discount received occurs when a business purchases goods or services from a supplier and is offered a reduction in price. This could be due to early payment, bulk purchasing, or promotional offers. Discounts help reduce the cost of purchases, improving the company’s profitability.

Types of Discounts Received

- Cash Discount – Offered for early payment of invoices.

- Trade Discount – Given for bulk purchases or as a promotional incentive.

- Seasonal Discount – Offered during specific periods, such as festivals or end-of-season sales.

Understanding the type of discount is important for accounting because it determines how the transaction will be recorded in the books.

Importance of Discount Received in Accounting

Recording a Discount Received Journal Entry is crucial because:

- It ensures accurate financial statements.

- Reduces the cost of goods purchased.

- Helps in tracking savings from suppliers.

- Maintains transparency in accounting practices.

Proper accounting of discounts also helps businesses make informed decisions about pricing, procurement, and cash management.

Discount Received Journal Entry – Meaning

A Discount Received Journal Entry is the process of recording discounts received in the company’s books of accounts. In double-entry bookkeeping, every discount received is treated as a credit because it reduces the overall expense of purchases.

Basic Accounting Rule

According to accounting principles:

- Purchase Account is debited with the net amount paid.

- Discount Received Account is credited with the discount amount.

This treatment ensures that both expenses and savings are properly recorded, reflecting the true cost of purchases.

How to Record a Discount Received Journal Entry

Here’s a step-by-step guide to record a Discount Received Journal Entry:

Step 1: Identify the Transaction

Determine the type of discount received and the amount. For example, if a supplier offers a $500 discount on a $5,000 invoice for early payment, the discount amount is $500.

Step 2: Prepare the Journal Entry

The general journal entry for a discount received is:

| Particulars | Debit ($) | Credit ($) |

|---|---|---|

| Accounts Payable / Supplier A/c | 500 | |

| Discount Received A/c | 500 |

Step 3: Post to Ledger

After preparing the journal entry, post it to the respective ledger accounts. This will help in tracking total discounts received during a financial period.

Example

Imagine your company buys goods worth $5,000 and receives a cash discount of $500 for early payment. The journal entry would be:

| Date | Particulars | Debit ($) | Credit ($) |

| 01/02/2026 | Accounts Payable / Supplier | 5000 | |

| Discount Received A/c | 500 | ||

| Bank A/c (Payment made) | 4500 |

This entry ensures that the purchase is recorded at the net amount while the discount received is accounted separately.

Benefits of Recording Discount Received

Properly recording discounts received has several advantages:

- Improved accuracy in financial statements.

- Tracking savings on purchases.

- Enhanced budgeting and cost control.

- Compliance with accounting standards.

Practical Tips for Businesses

- Always maintain a separate Discount Received Ledger.

- Reconcile discounts received with supplier invoices.

- Use accounting software for accurate posting.

- Review discounts at the end of the financial period to analyze savings.

Common Mistakes to Avoid

Even experienced accountants sometimes make mistakes when recording discounts:

- Recording the discount in the Purchase Account instead of a separate account.

- Forgetting to post the discount in the ledger, leading to inaccurate financial statements.

- Confusing Discount Received with Trade Discount, which is not recorded in books.

By avoiding these mistakes, businesses ensure accuracy and transparency in their accounts.

Discount Received vs Trade Discount

| Feature | Discount Received | Trade Discount |

| Nature | Accounting entry | Deduction on invoice |

| Purpose | Recorded to reduce expenses | Given by supplier to encourage purchase |

| Accounting Treatment | Credited in Discount Received A/c | Not recorded separately, net purchase amount is recorded |

Understanding the difference ensures proper journal entries and compliance with accounting principles.

Examples of Discount Received Journal Entry

Example 1: Early Payment Discount

A company pays $4,800 to a supplier for an invoice of $5,000. The $200 difference is a cash discount.

Journal Entry:

| Particulars | Debit ($) | Credit ($) |

| Accounts Payable / Supplier | 200 | |

| Discount Received | 200 | |

| Bank A/c | 4800 |

Example 2: Bulk Purchase Discount

A supplier offers a $1,000 discount for purchasing 500 units instead of 400 units.

Journal Entry:

| Particulars | Debit ($) | Credit ($) |

| Accounts Payable / Supplier | 1000 | |

| Discount Received | 1000 |

Example 3: Seasonal Discount

During a festival, a supplier offers a 5% discount on purchases worth $10,000. Discount received = $500.

Journal Entry:

| Particulars | Debit ($) | Credit ($) |

| Accounts Payable / Supplier | 500 | |

| Discount Received | 500 |

Conclusion

Recording a Discount Received Journal Entry is a crucial aspect of accounting. It ensures accurate financial reporting, proper tracking of savings, and adherence to accounting principles. By understanding the types of discounts, preparing correct journal entries, and avoiding common mistakes, businesses can maintain transparency and improve financial management.

If you found this guide helpful, share it with your peers, comment with your experiences, and start applying accurate discount recording in your accounts today. Proper accounting of discounts not only simplifies bookkeeping but also helps in analyzing cost-saving opportunities effectively.